8,000-word analysis of Snowflake, key marketing growth strategies in three stages

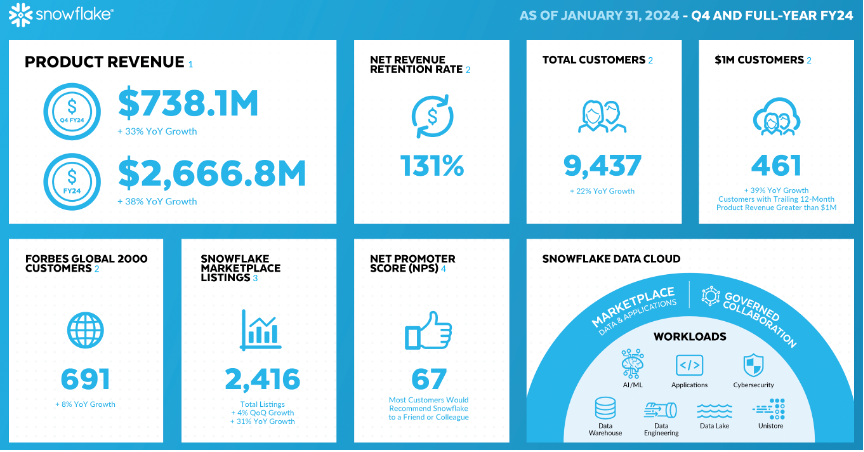

On March 6, Snowflake announced its fourth quarter revenue for fiscal year 2024 - $774.7 million, a year-on-year increase of 32%; total revenue - $2.806 billion, a year-on-year increase of 36%.

At this growth rate, Snowflake will most likely complete its own small goal ahead of schedule - "achieving $10 billion in revenue in fiscal year 2029" and enter the 10 billion club.

NDR (Net Dollar Retention) is an important indicator to measure whether an enterprise-level software is truly competitive in the market. The NDR Benchmark of excellent enterprise-level software in the world is basically 100%-125%. Snowflake is as high as 131%, which is enough to illustrate its excellent product capabilities and customer stickiness.

From its establishment in 2012 to its listing on the New York Stock Exchange in 2020, Snowflake has created the largest IPO in the history of software companies. Thanks to Buffett's support, it soared 111.61% at the opening, and its market value once reached $70.7 billion, with a PS of more than 50 times. Although the current stock price has been "halved" compared to the highest point, Snowflake is still one of the most highly valued stocks in the enterprise software market.

How does Snowflake continue to maintain high growth? What are the marketing growth strategies from 0-1 and 1-N? Starting from the development history, this article focuses on sharing the key marketing growth strategies in three stages. The full text is more than 8,000 words and is expected to take 8 minutes to read. The framework is as follows 👇🏻 You can directly read the part you are interested in:

Without this venture capital, there would be no Snowflake

The founder is always strong, and the CEO is always changing

Firing the first shot: Enterprise-level software can also "hunger marketing", and won 500 corporate customers in the first year of launch

Welcome the coming-of-age ceremony: 5 major marketing pillars to exceed 100 million US dollars in revenue

Scaled growth: ABM drives global expansion

The goal of Snowflake ABM

The configuration of the Snowflake ABM team

The 4-layer technology stack of Snowflake ABM

Without this venture capital, there would be no Snowflake

Sutter Hill Ventures (hereinafter referred to as "SHV") was founded in 1964 by William Henry Draper III, a leader in the venture capital industry.

The father of this leader pioneered the American VC model and was one of the pioneers of the American venture capital industry; his son is now the founding partner of the famous DFJ investment fund - Tim Draper. He is the "man behind" Tesla, Baidu, Twitter, Hotmail, etc. Three generations of grandparents and grandchildren focus on one inheritance...

Unlike many high-profile venture capital companies, SHV is very low-key. First, it rarely publicizes its success stories in public, and second, it basically chooses to leave the stage to entrepreneurs after the company grows to a certain scale. It has a reputation as a "silent builder" in Silicon Valley.

In 2008, Mike Speiser, who graduated from Harvard Business School, joined SHV as a managing partner. Compared with other investors, Mike Speiser has his own unique investment style:

Early involvement

Tends to intervene in entrepreneurial projects at a very early stage, and even starts cooperation when the team only has vague ideas. He will work closely with entrepreneurs to help them define their vision, build teams, and determine the minimum viable product (MVP) of the product.

Co-entrepreneurship

Consider himself as part of the entrepreneurial team, not just an investor. He will invest a lot of time and energy to work with the team to ensure the smooth progress of the project.

Resource matching

Good at matching entrepreneurial teams with appropriate resources, which may include other investors, partners or key talents. He will use his network and experience in the industry to facilitate these connections.

After joining SHV, Mike Speiser invested in the flash storage company Pure Storage and served as its CEO. The company is now listed on the New York Stock Exchange. With his successful experience in the database field, Mike Speiser proposed the idea of building a "next-generation database (based on flash memory)" in 2010 and began to look for incubation objects.

Coincidentally, Benoit Dageville (now one of the founders of Snowflake), who was still working at Oracle at the time, had a long-term cooperative relationship with Mike Speiser and had worked together to optimize the Oracle database.

However, when Mike Speiser found Benoit Dageville with great expectations, he was poured a basin of cold water. Benoit Dageville did not think that this idea was worth proposing and solving, and said "You are solving a problem that is not a problem"......

Benoit Dageville has worked at Oracle for 16 years and is well aware of users' complaints about Oracle's high costs, complex calculations, and difficulty in expanding data. He believes that if you really want to do something that generates huge value, you should focus on database computing rather than storage.

After many in-depth discussions between the two, both sides gradually agreed on a direction - using a storage and computing separation architecture to create a data warehouse on the cloud. So, our Benoit Dageville took his French compatriot Thierry Cruanes to "escape" from Oracle, and took a Dutch brother Marcin Zukowski to start the entrepreneurial journey.

The founder is permanent, the CEO is changing

Unlike most Silicon Valley companies whose founders are also CEOs, the two core founders of Snowflake have never served as CEOs since its inception. Instead, SHV investor Mike Speiser has been at the helm, matching the most suitable CEO for each different growth stage of Snowflake.

The first one, from 2012 to 2014, was held by Mike Speiser himself, laying a solid foundation for entrepreneurship

Compared with several technical founders, Mike Speiser has the most management experience and knows what is most important for start-up companies.

The founder focused on technology, and during this period he closed his eyes to design technical architecture and product architecture. Mike Speiser focused on company operations and the recruitment of start-up teams, etc., which is equivalent to an "all-round nanny". It is said that he personally contributed 80% of his time to Snowflake. This also laid a solid foundation for the early Snowflake.

Before 2013, Snowflake maintained a R&D team of 12 people, known as the "Dirty Dozen". But these people are not from Oracle, the commercial database giant, but they have specially found a group of engineers who are adapted to the cloud era.

The second term, from 2014 to 2019, invited Bob Muglia from Microsoft to lead Snowflake to "cross the chasm"

When the company grows to a certain scale, it needs professional managers to lead Snowflake from the early growth stage to a mature business operation model.

When Bob Muglia joined Snowflake, there were less than 120 people and the product had not yet been officially launched. How to transform cutting-edge technology into commercial products and "cross the chasm" became the main task of this period.

Left 2-Frank Slootman

Bob Muglia has extensive experience in the technology industry. He was the boss of Microsoft's current CEO Satya Nadella, and the original business leader of Microsoft Azure. Previously, he served as the vice president of the Server & Business Tools Division at Microsoft, leading the division to achieve annual revenue of more than US$15 billion.

During his tenure, Snowflake gradually completed its multi-cloud strategy. Initially, it only ran on AWS, and was launched on Microsoft Azure in 2018; and Google Cloud in 2019.

Today, AWS is still Snowflake's largest cloud vendor partner, accounting for about 78% of revenue; Microsoft Azure is about 18%, which is gradually increasing; Google Cloud is about 4%.

The third term, 2019-2024, the elderly Frank Slootman will come out again and lead Snowflake to become the largest IPO in software history

At this stage, Snowflake is in the process of sprinting to go public, and needs a CEO who has outstanding ability to lead enterprise software companies to go public and has more than one successful listing record.

Such people are not easy to find. Mike Speiser "visited three times" before inviting Frank Slootman, who was ready to retire and was fishing by the lake. After all, when he was ready to join Snowflake, Frank Slootman was almost 60 years old.

Left 2-Frank Slootman

Frank Slootman is affectionately called "Mr. IPO" in Silicon Valley, equivalent to Elon Musk of enterprise-level software. He has led Data Domain and ServiceNow to successful listing. During his 6 years as CEO of ServiceNow, he increased its revenue from 100 million US dollars to 14 billion US dollars.

This guy's work style is known for being radical and tough. He made drastic reforms as soon as he took office. For example:

Reorganize the sales team: divided into a key customer team and an industry customer team. Key customers are the focus of the company.

Disband the customer success team: Frank Slootman believes that everyone in the company should be responsible for customer success, not just the responsibility of a certain team, so he directly disbanded it 😺... and then reassigned these people to other departments.

The fourth term, 2024-present, Sridhar Ramaswamy, embraces the new era of AI

Just recently (March this year), Frank Slootman announced his resignation as CEO while continuing to serve as chairman. The new CEO is Sridhar Ramaswamy, the former senior vice president of AI.

Sridhar Ramaswamy worked at Google for 15 years and is a senior expert in artificial intelligence and machine learning (another 🇮🇳). How Snowflake will develop in the AI era depends on him.

Firing the first shot

Enterprise-level software can also be sold as a hungry marketing

Winning 500 corporate customers in the first year of launch

The landmark event that officially started Snowflake's commercialization journey was the joining of the second CEO Bob Muglia.

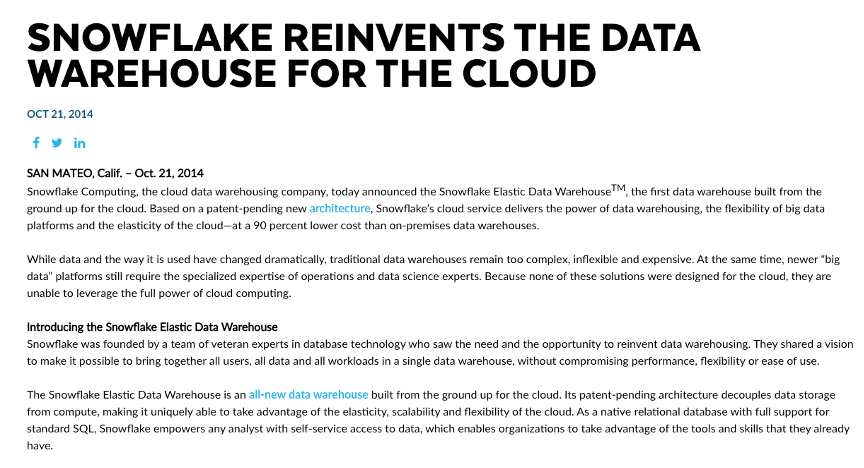

After Bob Muglia joined in 2014, on October 21 of that year, Snowflake publicly released the startup's first press release, titled "SNOWFLAKE REINVENTS THE DATA WAREHOUSE FOR THE CLOUD". Officially announced the launch of Snowflake Elastic Data Warehouse to the outside world.

Before the release of this press release, Snowflake had always regarded itself as "Stealth Mode" and had been hiding for more than two years. Even customer acquisition had always been carried out secretly by sending emails. In this way, the first batch of seed users was gradually accumulated, and the product-market fit (PMF) was also initially verified.

At this time, Snowflake already had:

Clear, clear and unique positioning

Data warehouse is not a new concept, but cloud data warehouse is.

Bill Inmon of IBM proposed the concept of data warehouse in 1990. Before Snowflake, data warehouses had gone through the development process from local proprietary hardware (representative product: Teradata), shared storage (representative product: EMC Greenplum) to big data Hadoop.

But Snowflake is the first data warehouse product based entirely on cloud computing architecture.

Product selling points that meet user pain points

User pain point A: Traditional data warehouses are too complex, inflexible and expensive

Product selling point A: Snowflake's cloud service separates data storage from computing, and can uniquely utilize the elasticity, scalability and flexibility of the cloud to provide the power of data warehouses, the flexibility of big data platforms, and the elasticity of the cloud, and the cost is 90% lower than that of local data warehouses.

User pain point B: Emerging big data platforms still need to rely on the expertise of professionals

Product selling point B: Snowflake is a native relational database that fully supports standard SQL. Any analyst can access data by themselves, allowing organizations to use their existing tools and skills.

Unique product value

-

DaaS (Data warehousing as a service). Snowflake eliminates the hassles associated with managing and tuning databases. This enables self-service data access so that analysts can focus on getting value from data rather than managing the underlying hardware and software.

-

Multi-dimensional elasticity. Unlike existing products, Snowflake's elastic expansion technology can independently scale users, data, and workloads to provide optimal performance at any scale. Elastic expansion makes it possible to load and query data simultaneously because each user and workload can get the resources they need without resource contention.

-

Unified business data services. Snowflake integrates the native storage of semi-structured data into relational databases and provides fully optimized query support for it. Analysts can query structured and semi-structured data in a single system without spanning multiple systems.

-

Persuasive endorsement from benchmark companies

During the more than two years of "StealthMode", Snowflake has accumulated a group of seed users. In this press release, customers such as Adobe, White Ops, VoiceBase, and Condé Nast endorse it.

Interestingly, it was almost a year after the first press release was released. On June 23, 2015, Snowflake officially released its data warehouse product to the public. During this period, Snowflake only provided the beta version to organizations they considered qualified (i.e. customers with the same target customer profile).

Do this:

On the one hand, it is to fully test and verify, leaving more time to verify business scenarios, test product reliability, performance, etc.;

On the one hand, it is one of the most important tasks in the PMF stage to accumulate more early users and find the right customers to use and polish the product;

On the other hand, it is to create expectations and demand, and create greater user demand and expectations through early publicity and attracting market attention, so as to obtain better market response when it is officially launched.

After its official listing, Snowflake has achieved great results:

In the first year of listing, it attracted more than 500 corporate customers, including many well-known technology companies and financial institutions.

In fiscal 2016, it achieved revenue of approximately US$60 million, a year-on-year increase of more than 300%.

With its innovative cloud data warehouse solutions, Snowflake has won wide attention and praise in the industry, and established a unique brand image and technical advantages since its debut.

Welcome the coming of age ceremony

Five major marketing pillars make revenue exceed $100 million

In early 2016, Denise Persson joined Snowflake as Chief Marketing Officer, leading the company to start data-driven scaled marketing growth.

This sister is very powerful. When she started working in 1996, she did not choose to join a large company, but joined a French startup Genesys, where she worked for 12 years, was promoted six times, and became the vice president of global marketing at the age of 27. During these 12 years, she opened offices in 25 countries around the world, participated in the acquisition of 14 companies, and had her first IPO experience.

Having said that, $100 million is the threshold for enterprise-level SaaS companies to be listed on the Nasdaq, and it is also generally considered to be the "coming of age ceremony" for enterprises. After Snowflake broke through $100 million in revenue, Denise Persson shared her thoughts on how marketing supports business growth, and summarized it into five major marketing pillars:

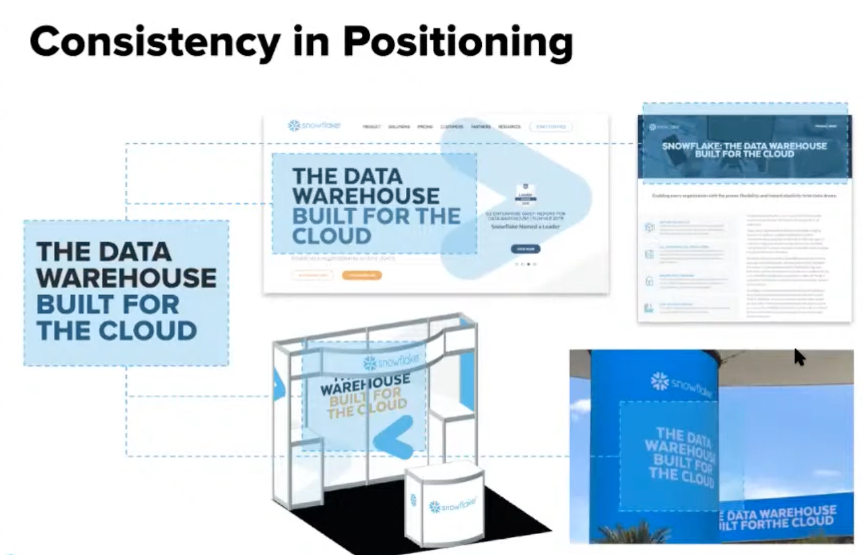

Pillar 1: Create strong positioning

Positioning is the cornerstone of marketing, just like the foundation of a house. If the foundation is not stable, cracks will easily appear in the wall. Therefore, creating a strong positioning is crucial to avoid loopholes in marketing.

Snowflake uses consulting companies to conduct in-depth discussions with real potential customers through the "focus group" model to ensure that the positioning resonates with those who don't know Snowflake.

Most companies only conduct a few interviews with existing or potential customers, but this is far from enough. Because positioning needs to be responsible for the company's next stage of growth.

As shown in the figure below, once Snowflake confirms its positioning, the phrase "data warehouse designed for the cloud" will be everywhere.

Pillar 2: Be the most customer-centric

Snowflake always puts customers first, so from the beginning it decided to create the most customer-centric marketing team in the industry.

First, through daily meetings with sales staff, ensure that customer needs are always understood. Snowflake's marketing team holds meetings with sales staff almost every day to keep abreast of the most important issues that marketing needs to solve.

Second, collect customer feedback through the customer advisory board and annual customer survey (NPS) and adjust marketing strategies accordingly. Snowflake checks and tracks every step of the customer journey, and if there is any problem at any step, it will "all hands on deck" to investigate the problem and solve it.

In the early days, to meet customer needs and expand content development, Snowflake had almost every employee participate in writing articles and producing videos. These contents are focused on what customers want to know, helping Snowflake build trust and credibility. This is what most B2B companies lack.

Pillar 3: Build for scale

Many ToB startups experience slowing growth after reaching $20 million in revenue because the entire company's workflow is still manual, and the marketing technology stack and processes are not built on a scalable foundation.

In 2017, Snowflake's annual revenue was approximately $96 million. In this year, the biggest topic discussed in almost every Snowflake all-hands meeting was about automation.

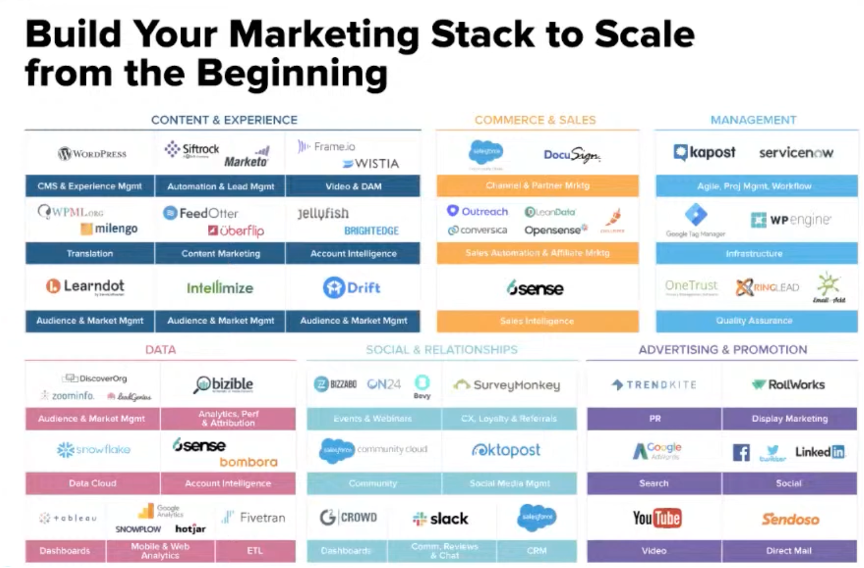

Automation is the foundation for ToB startups to achieve rapid and scalable growth. Snowflake only achieved the takeoff of free trials after the automation system was launched. As shown in the figure below, this is a panoramic view of the system currently used by the Snowflake marketing team.

Pillar 4: Be bold

Most ToB startups have limited budgets. What should they do to stand out in today's competitive market and compete with large companies and well-known brands? How to maximize benefits with a limited budget?

The Snowflake marketing team chose to be bold.

As an innovative product, Snowflake has a grand vision, and creating a bold brand is also consistent with its values and corporate culture. Boldness is of course risky, but it is also the best opportunity to get attention.

The 101 Freeway (US Route 101) is the main traffic artery in Silicon Valley, stretching from Los Angeles in the south to San Francisco in the north, with a total length of more than 1,500 kilometers, connecting countless technology company headquarters, such as Google, Apple, Facebook, etc.

Snowflake invested a lot of budget in the early days and put a lot of interesting advertisements on the 101 Freeway, such as "LOVE IS BLIND. DATA IS NOT", "YOUR DATA LAKE JUMPED THE SHARK", etc. At the same time, every billboard is repeating, repeating, and repeating the same positioning.

How much money is Snowflake willing to spend on marketing? Taking the data from Q2 of 21 as an example, the marketing expenses were close to 100 million US dollars, while the total revenue of this Q was only 272 million US dollars.

Of course, the huge investment also allowed Snowflake to quickly increase its brand awareness in the early stage. According to Snowflake's own statistics, at least half of the new employees admitted that they first heard about Snowflake from billboards. (PS: It is difficult to measure the effect of offline advertising with data. Onboarding surveys are the measurement method recommended by this CMO)

In addition to the "boldness" that costs money, there are also "boldness" that does not cost money.

Tech Marketing is a common marketing method used by American technology companies. Oracle, a veteran enterprise software giant, has always been the target of "attacks", and this time is no exception.

The previous article "Salesforce: Heroism + Gamification, Learn from the SaaS Originator to Use the Community to Activate Millions of Users Around the World" also mentioned that Salesforce also used Tech Marketing in the early days to quickly increase brand awareness by holding high "No Software".

As a representative of the emerging cloud database warehouse, Snowflake engineers will occasionally post fierce evaluation posts on major forums to challenge the status of Oracle, the representative of traditional database vendors.

This provocation has changed from an initial melee to a rational technical discussion. Sometimes, if it gets angry, it will receive an official response from Oracle. Over time, Snowflake has also established a certain reputation in the technical and analyst circles.

Pillar 5: Align with sales

The last and most important point is that the sales and marketing teams need to work together as a team.

A very important reason for Snowflake's rapid growth is that it has achieved strong consistency across the company from the beginning - the alignment point is around the Sales Pipeline.

An important job of the CMO is to ensure that the marketing team can maintain 100% cooperation with the sales team every day and always maintain the same execution.

In the early days of Snowflake, the CMO worked with eight sales development representatives every Monday morning to develop a marketing plan. Today, the two teams have more than 1,000 people combined and still maintain the same alignment.

Scaled growth -- ABM drives global expansion

Since 2018 (including the COVID-19 period), Snowflake has grown its product revenue by 300% in less than 15 months, with the key battle being the implementation of ABM (targeted customer marketing).

ABM focuses "marketing" and "sales" on a small number of companies that meet the ICP (ideal customer profile), with the common goal of "maximizing the conversion potential of target customers". The core lies in two points:

First, consistency, which requires collaboration across multiple positions;

Second, personalization, customizing interactive content for target accounts at different touchpoints.

Goals of Snowflake ABM

At present, the marketing teams of many B2B companies no longer focus on measuring a single channel, but turn to an overall channel view.

Because this allows marketing students to unite under the same goal and jointly promote revenue growth. Snowflake ABM has two goals:

Main goal: the percentage of accounts that have booked demos. The effectiveness of marketing activities is measured by determining how many target accounts have successfully booked demos.

Secondary goals:

Account interaction: target accounts visit Snowflake assets, such as websites, white papers, case studies, etc.

Opportunity rate: the proportion of target accounts based on scheduled demos that are further converted into business opportunities.

This measurement method emphasizes the high-quality interactive experience of target accounts, allowing marketers to focus on increasing brand awareness while sales teams focus on building customer relationships. The overall goal is to drive business growth through collaborative operations.

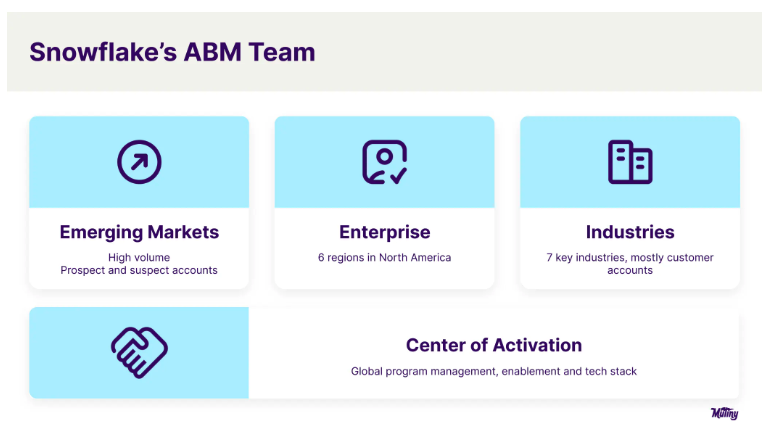

Configuration of Snowflake ABM team

Today, Snowflake's ABM team has 21 students, divided into four teams👇:

Emerging Market Team: Responsible for high-value potential accounts and intended accounts. The main responsibilities are:

Market research: Obtain relevant data through market research, analyze the potential of emerging markets, and help Snowflake better understand the needs and characteristics of new markets.

Market development: Responsible for opening up new market opportunities, especially in regions or industries that are not yet mature or developed.

Brand introduction: Introduce Snowflake's brand and products into new markets and increase brand awareness through various marketing strategies.

Partnerships: Build and maintain partnerships in emerging markets, including channel partnerships and strategic alliances.

Enterprise Team: Responsible for 6 major regions in North America. Main responsibilities include:

Key Account Management: Responsible for the company's largest enterprise customers and ensure that these customers receive first-class service and support.

Customized Solutions: Provide personalized solutions and product services based on the needs of large enterprise customers to meet their specific needs.

Customer Retention and Expansion: Implement customer retention strategies throughout the customer lifecycle while looking for upsell and cross-sell opportunities.

Senior Interaction: Maintain close contact with customer senior management to understand their strategic needs and provide corresponding solutions.

Industry Team: Responsible for major accounts and customers in 7 key industries. Main responsibilities include:

Industry Research and Insights: In-depth research and analysis of trends, pain points and needs in specific industries to ensure that Snowflake's products and services can accurately match industry needs.

Industry Solutions: Develop and promote solutions and use case demonstrations for specific industries to help different industry customers better understand and use Snowflake's products.

Industry Events and Content: Organize industry-related events such as seminars, conferences, white papers, and case studies to increase influence in specific industries.

Industry Relationship Maintenance: Build and maintain relationships with industry associations, leading companies, and opinion leaders to ensure Snowflake's strong positioning in major industries.

Activation Center Team: Responsible for global project management, empowerment, and management of all technology stacks for digital marketing. Main responsibilities include:

Marketing Automation and Execution: Responsible for implementing and managing various automation tasks for ABM activities to ensure that marketing activities run efficiently.

Content and Channel Management: Develop and distribute marketing content to maximize the reach and influence of activities through multiple channels (such as email, social media, websites, etc.).

Data Analysis and Optimization: Continuously monitor and analyze the performance of marketing activities, provide timely feedback and optimization suggestions to improve ROI.

Technical Support: Maintain and optimize the technology stack used for ABM activities to ensure that tools and platforms are in optimal condition.

Snowflake ABM's 4-layer technology stack

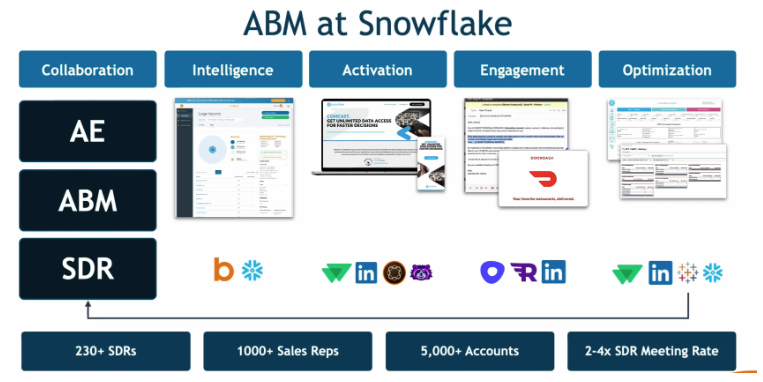

B2B procurement has a long decision cycle, usually taking 3-6 months or even longer. For marketing teams, multi-channel continuous reach is crucial. Snowflake's ABM technology stack is divided into 4 layers👇:

Intelligence layer

This layer integrates first-party and third-party data sources into Snowflake, depicting the full picture of "who", "where" and "when" the target account interacts with Snowflake, and creates lead scoring and intent algorithms on this basis.

Snowflake tends to build its own lead scoring criteria, fully control the buyer's journey, and reduce dependence on external suppliers. The tools used in this layer include:

Snowflake (data warehouse, Chinese benchmark products such as SelectDB)

Bombora (B2B intent data, Chinese benchmark products are unknown)

This layer has very high requirements for data governance, which determines:

Snowflake can segment the target market and identify the customer groups with the highest potential through detailed market research and data analysis. These segments are not just based on industry, size or geography, but also deeply analyze the business challenges, technology usage and purchasing behavior of potential customers to ensure the high relevance of marketing activities;

Snowflake can build detailed customer portraits, allowing marketing teams to create highly personalized, from email, social media to customized content marketing, each step is precisely connected to the specific needs and interests of customers.

Activation layer

The role of the activation layer is to transform the data collected by the intelligence layer into an ABM experience for each potential customer.

By identifying which accounts are actively browsing the Snowflake website or researching related products, the ABM team can deliver relevant information and calls to action to the right people when customer intent and interest are highest.

For example, Snowflake can trigger targeted ads to display to target accounts, and then link to personalized ABM microsites to communicate directly to the specific application scenarios of the account. The tools used in this layer include:

Mutiny (personalized website experience, Chinese counterparts are unknown)

Rollworks (end-to-end ABM, Chinese counterparts include Zhiqu Baichuan, Jingshuo, Huoyanyun, etc.)

LinkedIn (B2B workplace precision delivery, Chinese counterparts include Maimai)

This layer has very high requirements for automation, which determines:

Snowflake can ensure seamless integration of marketing and sales processes through tools. Automated workflows, such as dynamic content generation, triggered emails, and intelligent recommendation systems, can efficiently manage a large number of personalized marketing activities while maintaining the quality of each interaction;

Engagement layer

This layer is the channel for delivering activation content. Snowflake tightly integrates its ABM program with the sales team, so activation can be implemented through both the SDR team (outbound calls) and the online team (traffic diversion). The tools used in this layer include:

Outreach (sales automation, Chinese counterparts such as SalesEasy, Fenxiang Sales, etc.)

Reachdesk (B2B personalized gift giving, customer experience management, Chinese counterparts unknown)

This layer has very high requirements for teamwork, which determines:

Snowflake's sales and marketing teams can work closely together to form a "one team" culture. The marketing team is responsible for creating compelling content and experiences, while the sales team establishes in-depth dialogues with customers based on these contents. Both parties share intelligence and work together to develop strategies to ensure that marketing activities can effectively convert into sales opportunities.

Optimization layer

This layer is used to analyze all performance data and make recommendations for future adjustments. As Snowflake continues to expand into new markets, it needs to clearly see which strategies are effective and which are not ideal in order to continuously iterate.

These insights will be summarized, and the ABM leader, account executive manager (AE), SDR and other collaborators will share and discuss them in a meeting every two weeks. The tools used in this layer include:

-

Snowflake

-

Rollworks

-

Tableau (data analysis, Chinese counterparts such as Sensors Data and GrowingIO)

-

LinkedIn

This layer has very high requirements for data analysis, which determines:

- Snowflake can establish a feedback loop to continuously monitor the performance of ABM and adjust strategies based on data feedback. Through A/B testing, customer feedback collection and marketing effect analysis, Snowflake can continuously optimize ABM strategies to ensure that each stage can better meet the needs of target accounts while looking for new opportunities for scaled growth.

The above layers work together to form Snowflake's efficient, data-driven marketing system, ensuring high personalization and maximum effectiveness of marketing activities, while also promoting close cooperation and continuous optimization between teams.

Today, Snowflake's business has spread across many companies and regions such as North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa, and ABM has been playing an important role in global expansion.