How to continue the growth potential from 0 to 1 through refined marketing

When a company has entered the global market for a period of time (about 1 year) and has established a foothold, it usually has the following characteristics:

- The positioning and messaging of the product have been basically stable after multiple rounds of iterations. The value prop considered by the company is basically consistent with the user experience.

- The founder-led sales method has achieved initial success. The efficiency may not be the highest, but it can have enough volume to maintain the momentum required at this stage.

- There is at least one growth channel that can provide a growth rate that takes into account both volume and efficiency.

- The target population targeted in the earliest stage has achieved good recognition. The indicators related to this group of people, such as web to signup conversion or retention, are at a good level compared to industry standards.

- In general, the product is still based on a single function and selling point. However, it will take some time for products like Notion to expand from a single function to a multi-function product.

At this time, some challenges usually begin to emerge. Based on observations of everyone's explorations and experience summaries, for example:

First, the existing target customer ceiling is low, and it is very likely that the revenue growth rate cannot be maintained. There is a high probability that a bottleneck will be encountered in the near future. So how can we plan ahead to find a breakthrough for expansion?

For example, after Equals (https://equals.com/) captured a part of the core users, it began to use the Freemium pricing model that almost every SaaS would consider to expand non-core users, which resulted in a counterproductive effect. Here is an in-depth sharing of theirs [1].

Then they turned around and focused on serving core users, and then found that there was actually a lot of room for growth. This is a good example of "deep product development" - digging deep into core users, not expanding too early, and solving the so-called growth problem by satisfying their needs to the extreme.

In addition, Chorus.ai is also a good example. Compared with Otter.ai's expansion of users, they decided to seamlessly integrate with Zoominfo. Finally, due to the ultimate experience in AI and workflow after the deep integration, it was acquired by Zoominfo for US$575 million, which produced a very big chemical reaction in the vertical direction.

There are also general productivity tools, such as Sightx.io, a great market research tool. After gaining good enterprise customers in the early stage, it also encountered bottlenecks. Therefore, it began to actively explore how to reach more startups with high demand for market insights without major adjustments to "reduce dimensionality".

There are many similar examples. The most important thing at this stage is to make a decision - whether to go vertical or horizontal, that is, vertical or general? Michael Ho's article [2] provides a good framework. Depending on which route to take, the focus within the company will be very different. This decision will also have an extremely significant impact on the subsequent financing story. In many cases, it is one of the top three factors that determine whether the next round of financing can be raised.

Secondly, the efficiency of the growth channels that the existing target customers mainly rely on has begun to decline, and more and more effective growth channels need to be found quickly.

When many startups determine the PMF, they usually find 1-2 channels to support a certain amount of founder-led sales, such as Linkedin's organic communication, active outreach, partnership, etc.

Usually these initial channels can easily reach bottlenecks, so the next step is to actively explore channel expansion. The problem is that there are too many channels! Grammarly is operating up to 30 marketing channels on the B2C side at the same time. For startups that have just come out of PMF, how to choose the right channels, how to screen reliable agencies or freelancers, how to ensure that the execution can be smoothly implemented and produce the desired results, etc., each step may be a major challenge for the team.

At this time, at least one cofounder needs to step up and play a part in the role of head of growth. You can consider looking for a more experienced mid-level marketer who can roll up his sleeves and get things done. It is usually not suitable to find a high-level CMO, but you can consider finding a suitable advisor to spend a little time to help the team correct and avoid unnecessary detours.

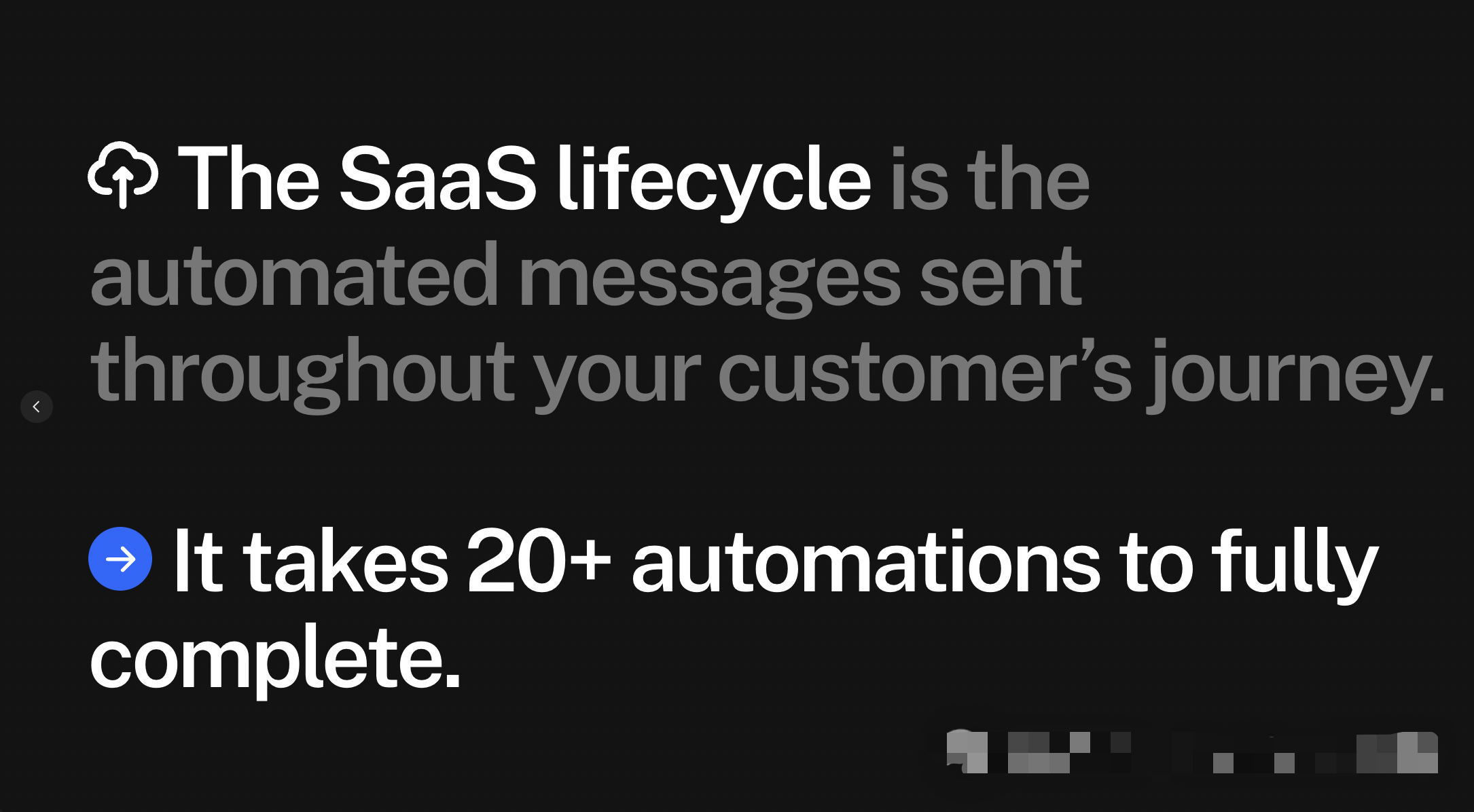

Third, too much emphasis on new traffic, no resources to properly manage registered users, such as building a complete life cycle email reach (lifecycle email), or effective product value delivery (product messaging), etc., resulting in the loss of hard-earned traffic quickly.

I have signed up for countless SaaS and AI applications in the past year, and what surprised me was that most of them rarely sent emails to maintain regular communication after I signed up. Usually there is a welcome email, and then there may be another very brief reminder after a long time, and there are few others.

Investing in the user lifecycle is a choice with a very high ROI. Many users have just signed up for a product they have not heard of. Lifecycle is almost the best channel to convey more product information to new users, communicate the background of the team, provide the latest product updates and promotions, etc. Most importantly, compared to other growth channels, email and product messaging are almost free!

In the recent Fintech project experience, we easily obtained a lot of registered users from Google, but they were very hesitant to put their money in a platform they had never heard of for a long time. We decided to increase the frequency of emails from once every two weeks to three times a week. In the content, we communicated in detail, such as: CEO letter, story behind the latest product, new product launch, product development milestones, competition, monthly promotions, etc.

Although it caused a small number of users to unsubscribe, the key point was that we successfully won the trust of many waiting customers, so that they started to "pay". In the case of other growth methods, especially the overall investment did not increase significantly, email contributed to the nearly 20-fold revenue growth in half a year (the other was the development of the product itself).

One of the reasons why the above methods are not taken seriously is that many senior marketing experts are unwilling to contact companies at this stage to help them build this project. Because there are not many customers at this time, the effort invested, even if it can bring a 10-20% increase in conversion rate, usually does not bring enough commercial value, and the company's ability to pay is not high. This results in the stage and team that need help the most being the least able to get the necessary help.

One of my favorite lifecycle marketers has a free framework on his personal website Ottomate[3], which also provides short-term training. This is very suitable for companies at this stage to consider. They can first train the company's internal marketer (or the cofounder himself!) to become an 80% lifecycle expert, and then consider looking for a more professional team when the scale is up.

Fourth, the company's "data infrastructure" was weak before, and it began to be unable to support the next stage of growth. Some changes need to be made at the bottom level to avoid hindering growth.

Startups usually don't need infrastructure at the beginning, such as various products that support data recording, storage and analysis. Basically, they just input the investment situation of sales/product/marketing with their left hand and check the final results with their right hand. However, when they have established a firm foothold and reached a certain scale, the pain points of lack of infrastructure begin to become gradually obvious, such as:

- There is no UTM setting in the database, so it is impossible to identify which marketing channel is the most efficient, especially when there are more than two delivery channels, which limits the optimization of details of cost and CAC.

- Lack of experience leads to inappropriate tools. For example, if a startup uses Hubspot for email marketing, it may not be suitable to use CustomerIO.

- Without setting up a Customer Data Platform (such as Segment) to connect different data sources, user information is fragmented, such as user transaction data and app usage data. Or it may even not exist, such as user funnel data on the web page. In this way, even if there is a major bug in a certain link that causes the conversion to be unsmooth, there is no way to effectively detect and correct it.

- Lack of effective analysis and BI tools and "thinking patterns". I have seen some very early teams using Tableau, but due to lack of support, it is not used sufficiently. In contrast, there are many tools suitable for early teams, such as Domo and HyperQuery, or the recently very popular Equals.

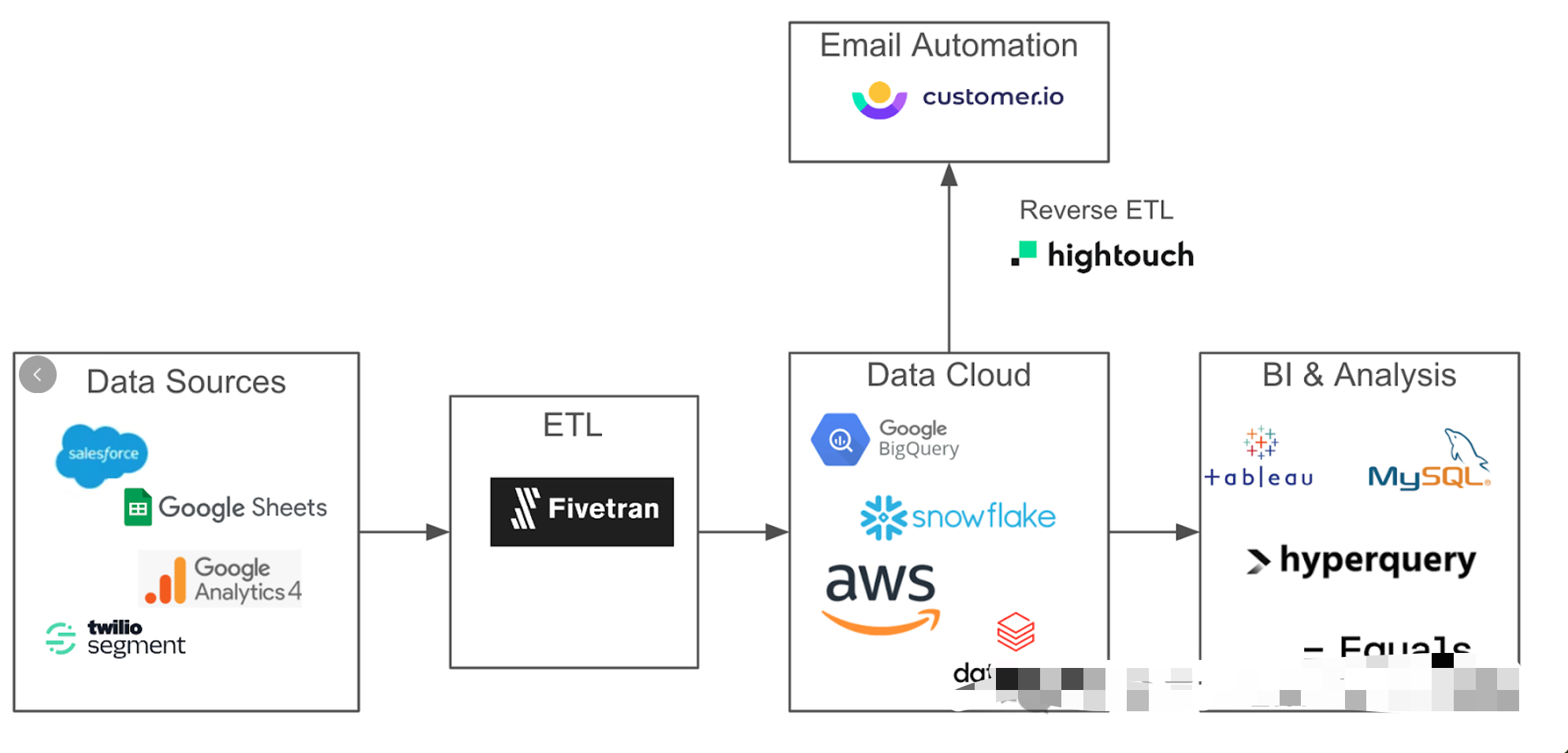

Finally, companies need to choose the most appropriate and mainstream tools for data analysis. You can refer to the summary of Demand Curve for details in this article "[4] Marketing Tools (Beginner's Guide)" [5]. I will share a framework for building data infrastructure from a growth perspective for readers' reference and to help everyone avoid detours as much as possible. The framework is divided into the following parts:

Data source: Sort out the data source. For example, B2B will have a lot of data in Salesforce CRM, web data in Google Analytics, and Google sheets will also have various data.

A useful tool is Segment. Segment can easily extract data from the ID level web funnel, and can be connected with internal data to see the full picture of the data. For example, what is the path of users who recently purchased the product on the web page. Although internal engineering tracking can also achieve this, it is a very resource-saving approach for startups to use Segment directly.

ETL (Extract, Transform, Load): When there is a data source, it needs to be efficiently transferred to the database. Nowadays, every company has a lot of data sources. In addition to the data inside the product and CRM data, how to aggregate the data of countless advertising platforms such as Google Ads is a very headache problem.

On the one hand, you can stack engineers to do it, but it is more convenient to use a no-code tool such as Fivetran to export the data cleanly through the pre-built architecture. It is also the best choice for startups, especially when engineering manpower is usually extremely scarce.

Data Cloud: I won’t say much about this part, as they are all very familiar cloud databases such as Google Big Query, AWS, Snowflake and Databricks.

Reverse ETL: Many times, companies need to send personalized emails, and need to transfer various tags from the database back to the email tool. This was previously solved by the engineering department, but now no-code tools like Hightouch can easily do it without engineering.

BI & Analysis: This part traditionally uses analysis tools such as MySQL or BI tools like Tableau. Analysis tools generally require strong coding skills. BI tools like Tableau also require specialized BI analysts or engineering capabilities to be more beautiful, and they are still very technically in-depth.

But recently, one of the tools I encountered that is very suitable for startups is Hyperquery, which can directly connect to the database, do SQL/Python and AI-assisted drawing and collaboration in one interface. Although coding skills are also required, it greatly simplifies the work process.

Another very impressive thing is Equals, which also connects to the database, and then uses AI to do various efficient data analysis and visualization in an interface that is very similar to Google Sheets. It provides great help for those who are not good at coding, and also greatly reduces the dependence on engineering.

The above is the first issue of the "X Growth" column. Practice makes perfect. In the process of globalization, readers and entrepreneurs are welcome to leave messages in the background and contact us. Looking forward to hearing more experiences and gains, see you next time!

References:

[1]https://notoriousplg.substack.com/p/nplg-101223-freemium-really-hurt?utm_source=post-email-title&publication_id=409899&post_id=137887088&utm_campaign=email-post-title&isFreemail=true&r=6xp5v

[2]https://www.linkedin.com/posts/themichaelho_horizontal-vs-vertical-startups-activity-7143280137235603457-lRYW?utm_source=share&utm_medium=member_desktop

[3]https://www.ottomate.co/saas

[4]https://www.demandcurve.com/playbooks/marketing-tools-beginners-guide

[5]https://www.demandcurve.com/playbooks/marketing-tools-beginners-guide